Setting up a New Jersey LLC is not expensive and costs as little as $125.

Generally, setting up a New Jersey LLC is not expensive. The only mandatory payment is to the State, but LLC members can pay more if they use service providers. Below is a breakdown of possible costs.

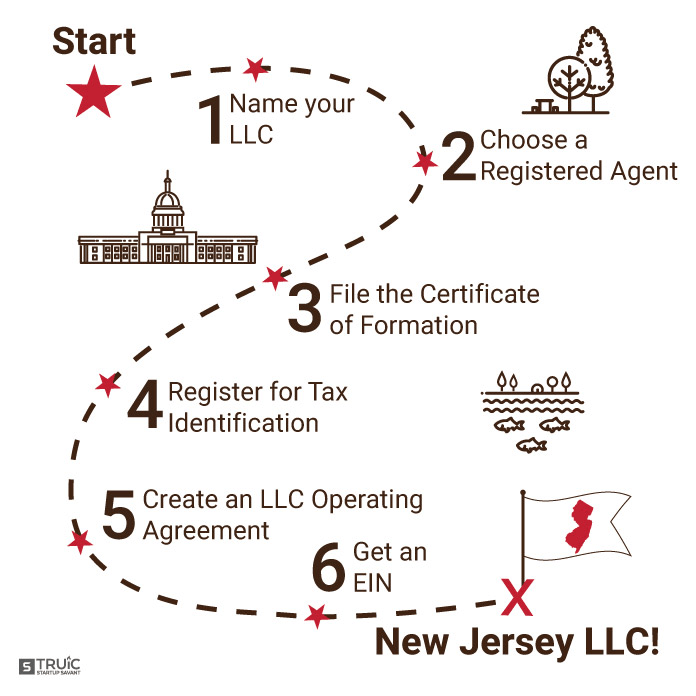

Filing the LLC ($125)

Contents

Filing a Public Records Filing for an LLC in New Jersey costs $125. This is a one-time fee charged by the Secretary of State in order to get a Certificate of formation. There are no other charges from the state.

Filing online is easier and faster (approval in 1 to 2 days) than filing by mail, by fax or in person. When filing by fax or in person, it’s possible to get the LLC formed within 1 hour for $1,000 or within 2 hours for $500. This is convenient for someone who’s in a hurry.

Registered agent ($0 to $125)

Members of New Jersey LLCs are required to have a registered agent to act as the link between the company and the government. If they choose one of the members to be a registered agent, the cost is nil.

It should be noted that the registered agent has to list a physical address that becomes a permanent record of the LLC. If a member is a registered agent, the physical address is likely to be a home address which becomes public knowledge. The registered agent has to be available at the address during business hours to accept legal notifications. Being in a hospital or meeting is not an acceptable excuse to the State. For that reason, members of an LLC may decide to make use of an external commercial registered agent, at a cost of anything up to $125 per year.

New Jersey LLC Registration ($0)

The state of New Jersey requires newly formed LLCs to register with the Division of Taxation within 60 days of formation or within 15 days of commencing business operations. It can be done online (takes about 15 minutes), which is called Business Registration Application. It can also be done by mail, a process known as NG-REG.

LLC’s EIN ($0-$100)

The LLC is expected to get an Employer Identification Number (EIN) (also known as the Federal Tax ID Number) from the IRS. This is particularly important if it has employees or has to file certain federal excise taxes like those for alcohol, tobacco or firearms. The number is also important for opening bank accounts. This is a free service offered by the IRS. However, if the LLC members decide to use a service provider for the process, they can pay anything up to $100.

Creating an LLC operating agreement ($0 to $200)

A new Jersey LLC operating agreement can be created for free by the members using a free template. However, they may choose to use a professional a fee or use a paid template.

Register with New Jersey Division of Revenue ($0 to $100)

Within 60 days of formation, the LLC must be registered with the New Jersey Division of Revenue. This is a free service. If a service provider is used, the LLC can expect to pay up to $100.

Business license ($0 to…)

The State of New Jersey doesn’t issue state business permits and licenses. However, some cities and counties require local licenses for certain types of business. So, the cost of permits/licenses may be nil or it can be whatever the county/city charges.

Setting up a New Jersey LLC is affordable

If the members of an LLC are prepared to do all the work, they will pay $125 for filing the LLC plus any permits that may be needed. If they use service providers, they will pay up to $525 plus the cost of any permits required. Professional websites, like TRUiC websites have all the information and guidelines for anyone who plans to set up an LLC in New Jersey. Visit the website for more information.