When it comes to choosing a trading broker, understanding the fee structure is crucial. ADS Securities (ADSS) is a well-known broker that offers a wide range of financial instruments and advanced trading platforms. This review delves into the various fees associated with trading on ADSS, helping you make an informed decision.

Overview of ADSS

Contents

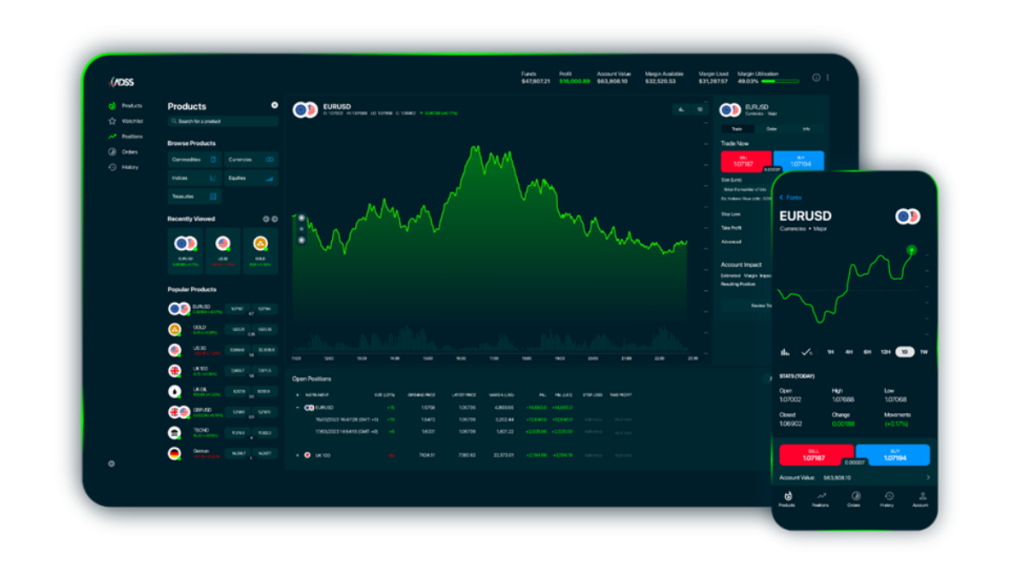

ADSS has established itself as a reputable broker in the trading industry. Known for its comprehensive range of trading instruments, ADSS offers access to forex, stocks, commodities, indices, and CFDs. With advanced trading platforms like MT4, and proprietary platforms, ADSS provides traders with a robust and reliable trading environment.

Types of Fees Charged by ADSS

Spread Definitions and Application: The spread is the difference between the buy and sell price of a trading instrument. ADSS charges spreads on various instruments, which can vary based on market conditions and the specific instrument being traded.

Commission Charges: While some instruments like forex pairs are typically traded with just spreads, others, such as stocks and ETFs, might incur commission charges. These commissions can be fixed or vary depending on the trading volume.

Non-Trading Fees

Deposit and Withdrawal Fees: ADSS supports multiple payment methods, including bank transfers, credit/debit cards, and e-wallets. Each method may have different associated fees, and these costs can impact your overall trading expenses.

Inactivity Fees: If an account remains inactive for a certain period, ADSS may charge an inactivity fee. Understanding these conditions can help you avoid unexpected charges.

Currency Conversion Fees: When trading instruments in a currency different from your account currency, ADSS may charge a conversion fee. Being aware of these fees can help you manage your costs effectively.

Platform and Data Fees

Trading Platforms: ADSS offers several trading platforms, each with its own fee structure. While MT4 might come with no additional cost, proprietary platforms or advanced features could incur extra charges.

Real-Time Data and Market Analysis Tools: Accessing real-time data feeds and advanced market analysis tools might come at a cost. These fees can vary based on the level of access and the specific tools required.

Comparison with Industry Standards

When compared to other leading brokers, ADSS’s fees are competitive. However, the exact impact on your trading costs will depend on your trading volume and the instruments you trade. While ADSS offers low spreads and competitive commissions, it’s essential to consider all potential fees to gauge the overall cost-effectiveness.

Detailed Breakdown of Trading Fees

It’s important to understand the fees related to trading before jumping in.

Forex Trading

ADSS provides competitive spreads for major, minor, and exotic currency pairs. Major pairs typically have lower spreads, making them more cost-effective for frequent trading.

Stock and ETF Trading

Commission structures for stocks and ETFs can vary. ADSS charges per trade, with differences based on the market (e.g., US stocks vs. non-US stocks). Understanding these commissions is vital for stock and ETF traders.

Commodity and Index Trading

Trading commodities and indices on ADSS involves specific fees. These can include both spreads and commissions, depending on the instrument. Knowing the fee structure for commonly traded commodities and indices can help you plan your trades better.

CFD Trading

CFD trading on ADSS comes with its own set of fees. These can include spreads, commissions, and overnight financing costs. Traders should consider these fees to fully understand the cost of trading CFDs.

Detailed Breakdown of Non-Trading Fees

Understanding the non-trading fees associated with ADSS is crucial for managing your overall trading costs and ensuring that unexpected charges do not impact your profitability.

Deposit and Withdrawal Fees

Different payment methods have varying fees. Bank transfers might be free or have minimal charges, while credit/debit cards and e-wallets could incur higher fees. It’s important to check these fees before making deposits or withdrawals.

Inactivity Fees

ADSS charges inactivity fees if there is no trading activity for a specified period. To avoid these fees, ensure regular trading or account maintenance.

Currency Conversion Fees

Trading in a currency different from your account’s base currency can result in conversion fees. These fees are usually a percentage of the transaction amount, so understanding and minimizing these costs is crucial.

Platform and Data Fees

While MT4 is widely used and might come with no extra cost, ADSS’s proprietary platforms may have fees for advanced features. It’s beneficial to evaluate the costs against the features provided.

Real-time data feeds and advanced market analysis tools can enhance trading but may come with additional fees. Weighing the benefits against the costs can help you decide whether these tools are worth the investment.

Hidden fees can significantly impact your trading profitability. Carefully review ADSS’s fee schedule and terms of service to identify any potential hidden costs. Regularly monitoring your account statements can also help you spot unexpected charges.

Conclusion

ADSS offers a comprehensive and transparent fee structure. While its fees are competitive, understanding the full range of potential costs is crucial for managing your trading expenses. Whether you’re trading forex, stocks, commodities, or CFDs, being aware of ADSS’s fees ensures you can trade more effectively and profitably.

For more detailed information on the broker, check out this ADSS review: https://tradingbrokers.com/reviews/adss-review/.