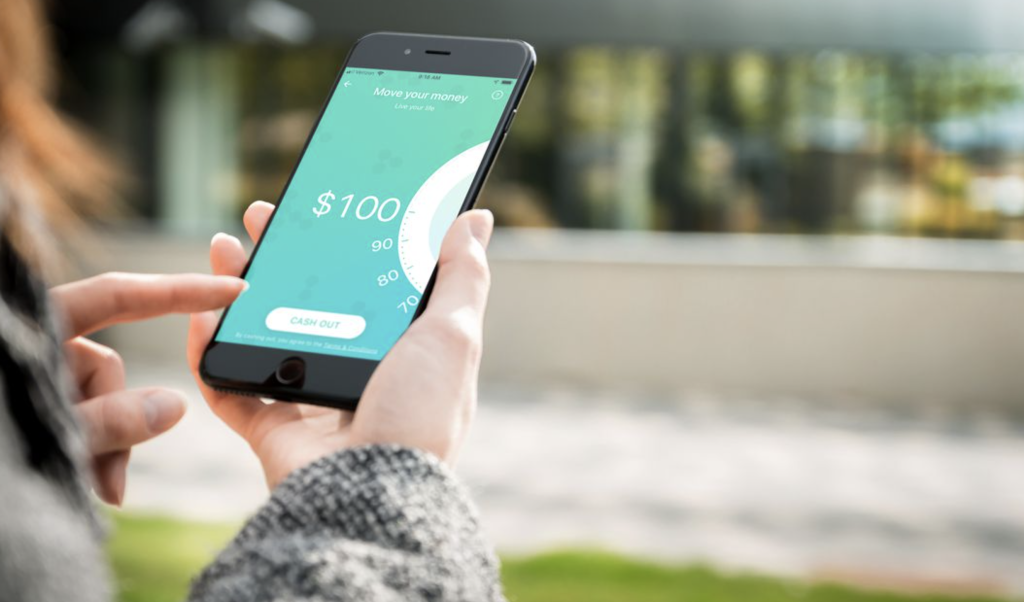

When using a smartphone app to get a loan, you need to make sure that the lender you are working with is legitimate and will be able to approve your loan in a timely manner. This can be difficult to ensure when you are applying for a personal loan on the go, but with Payday TX, there is an app available that can help. This loan app is specifically designed to work with the payday loans provided by mobile phone stores. These stores offer short-term cash loans that must be repaid within a certain timeframe. Similar to other types of personal loans, you will want to meet your financial obligations before applying for another loan from this particular lender. To get started, you will need to download the PayDay Texas mobile app. Once downloaded, you will then have access to a secure online application process that is also backed by fast and efficient customer service. All of this is available so that you can get a loan in as little as 15 minutes. It’s important to remember that this process doesn’t apply only to people who need cash quickly — it also caterers to people who might not have credit history or may not have access to other financial resources. In order to qualify for a payday loan from this particular lender, you must meet certain criteria such as:

Be at least 18 years old.

Contents

Some states do not allow minors to participate in the lending process, so you will need to be at least 18 years old to apply for a payday loan in Texas. This is the same for most states where this loan is offered, so it is important to check the laws in your area before applying.

Be a Texas resident.

Like most states, you must be a full-time resident of Texas in order to apply for a payday loan. If you are only a temporary resident, you will have to provide proof of your status when you are approved for a loan.

Have a current payment on your credit or bank account.

This is important because you will need to have a current account in order to show the lender that you have funds available to repay the loan. Without a current balance, the lender will not be able to make a loan approval decision. Without a current balance, you will not be able to borrow money and will be required to return all funds to the lender as soon as you are able to repay them.

Have a job and be looking to take a loan to meet your financial obligations.

This is important because the lender will only approve a loan if they believe you have the ability to repay it. By showing the lender that you have a job and are looking to borrow money in order to meet your financial obligations, you help to secure a favorable loan approval decision. Have no criminal record. Like most states, the Federal Trade Commission requires that lenders review your credit history in order to approve you for a loan. It is important to note that this does not apply to small debt like missed rent or trash collection fees — those debts will still need to be paid back when the account is current.

Have access to a smartphone that is pre-installed with the PayDay Texas app.

This is another important requirement. Most smartphone stores and app providers now offer interfaces that will allow you to easily create an account, create a loan request and apply for a loan. It is important to remember that the app will only work with specific phone providers.

Summing it up

The point of all this is to get you to think about your financial situation and the ability to repay a loan before taking out a dollar loan. These types of loans are typically short-term, so be sure to meet your financial obligations before applying for another loan. In addition to all that, the PayDay Texas loan app provides a great way to get cash in a hurry. Apply for a loan Click here; https://www.paydaytx.com/apply-now